Invalid and Improper Bylaw Amendment

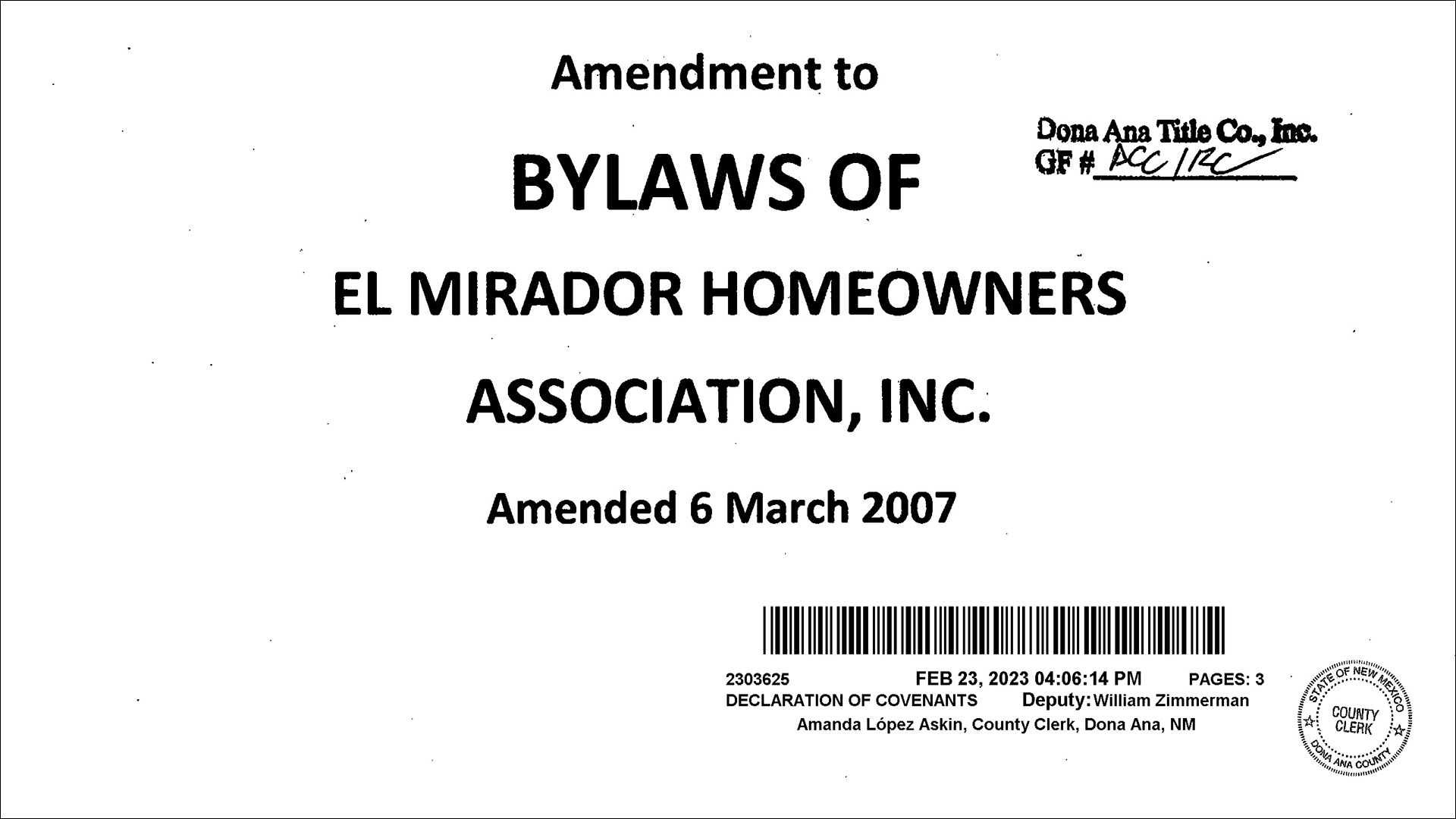

Marked-Up Copy of El Mirador Homeowners Association Bylaws Amendment, February 23, 2023

Marked-Up Copy of El Mirador Homeowners Association Bylaws Amendment, February 23, 2023

To view the PDF on an iOS device, click the image to the left or use the download link. The PDF is also embedded at the bottom of the page, but its accessibility may vary depending on your browser.

Download Amendment to Bylaws of the El Mirador Homeowners Association, February 23, 2023

TL;DR

SUMMARY

- Section 47-16-18, from the New Mexico Homeowner Association Act, requires all homeowners associations (HOAs) and lot owners to comply with the Act and the HOA's governing documents.

- On February 23, 2023, the El Mirador Board of Directors recorded an invalid amendment to the bylaws with the Doña Ana County clerk's office. They made no announcement to members regarding the amendment or its recording.

- The Board claims the amendment results from "a majority vote of the members of the Association, via printed ballot, at the Annual Meeting of the Members held on March 6, 2007." Despite multiple written requests, the Board refuses to provide any evidence this vote occurred or any of the materials related to it, such as notice to members, ballots, etc.

- The amendment seeks to waive the Treasurer's obligation to pay "Association Dues." It is comprised of nineteen (19) words and one comma inserted into existing Bylaws art. III § 9 : "with exception of the Treasurer whose compensation shall be a waiver of their monthly Association Dues while in office,"

- The amendment has not been properly made, and is therefore invalid:

- It has not been certified by the Association's Secretary. See Bylaws art. V, "Any amendments approved by the members of the Association shall be certified by the President and Secretary..."

- The amendment violates the Declaration of Covenants, Conditions and Restrictions. See Bylaws art. V, "[P]rovided that no amendment shall be in violation of the Covenants for El Mirador Subdivision." See also Declaration § 5.9, "All Assessments shall be payable in the amount specified in the Assessment or notice of Assessment and no offsets against such amount shall be permitted by any reason..."

- The amendment violates the Articles of Incorporation for the El Mirador Homeowners Association, Inc. See Articles § VI, "No part of the net earnings of the Association shall inure to the benefit of, or be distributed to, its members, directors, officers, or other private persons..."

- According to the IRS, canceled debt is taxable as ordinary income and under these circumstances must be reported as a constructive distribution. See IRS Publication 542, page 17 paragraph 3, Constructive Distributions, "Corporation cancels shareholder's debt. If a corporation cancels a shareholder's debt without repayment by the shareholder, the amount canceled is treated as a distribution to the shareholder." See also IRS Publication 4681 Canceled Debts.

- The Association appears to be treating the amendment recorded in 2023 as being retroactive to 2007, violating the bylaws. See Bylaws art. V, "Any amendments approved by the members of the Association....shall be effective when recorded in the office of the County Clerk of Doña Ana County, New Mexico."

- The meaning of the term "Association Dues" is unclear and undefined. Does it mean assessments, and if so, which assessments? See Declaration § 5. There are 4 categories of assessments: Regular Assessments; Special Assessments, Capital Improvement Assessments and Reconstruction Assessments. In addition to assessments, the Association may collect fines and other penalties, such as late charges, attorney fees and interest. Is the amendment intending to provide a blanket waiver of any charge of any type against each and every lot of the Treasurer, and apply to his co-owner(s)?

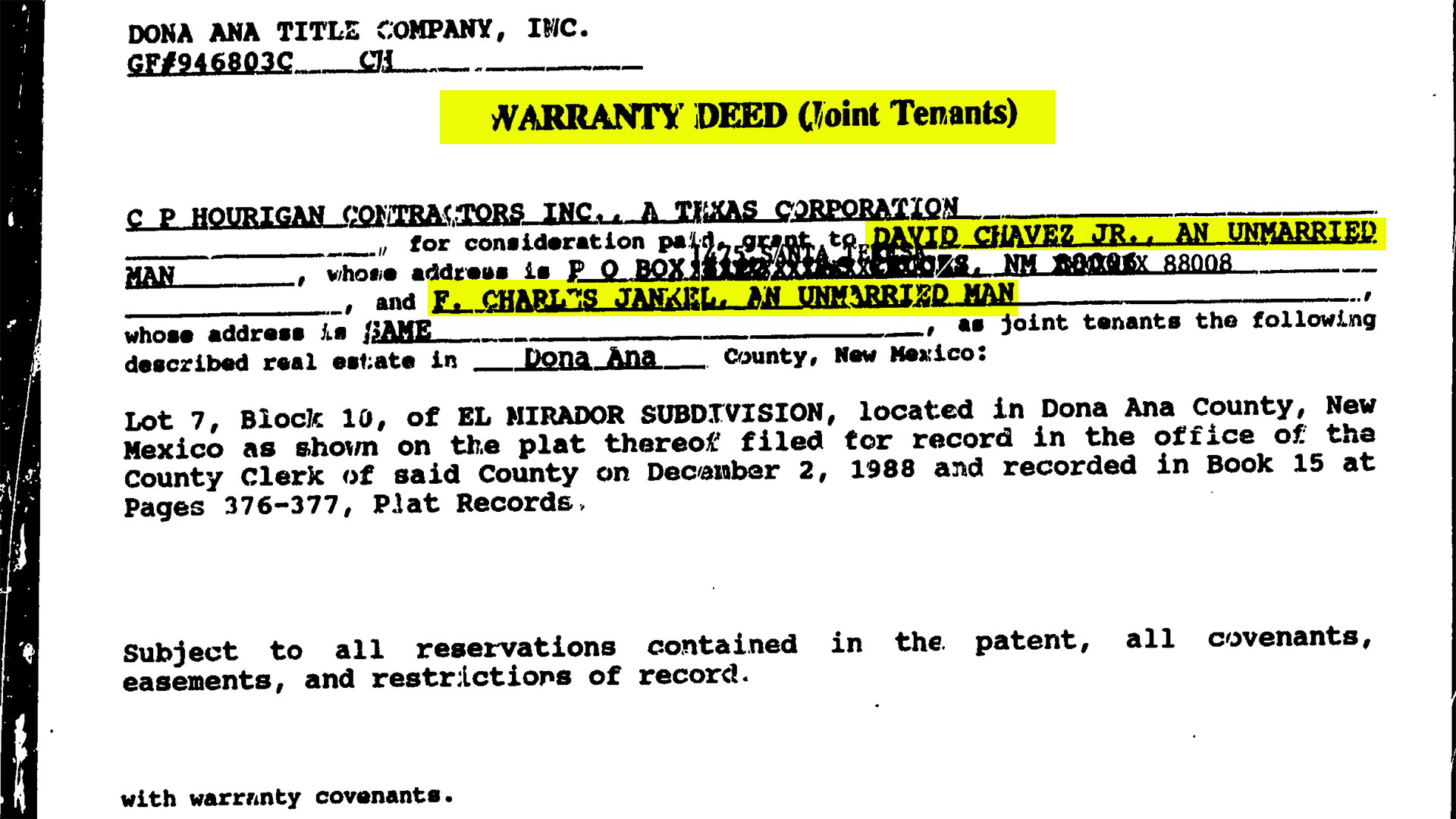

- The amendment benefits only David Chavez, Jr.* However, the Association seems to be allowing Francis Jankel, the joint tenant of Chavez' lot, 333 Avenida Mirador, to waive his dues as well. As joint tenants, Chavez and Jankel are responsible for their share of dues for the lot they co-own. Chavez only owns 50% of the lot, and therefore could only waive his share of any Regular or other Assessment, fines or other charges to the lot by the Association. Jankel is likewise obligated to pay his proportionate share, which is not included in the purported waiver. * The Associations lack of enforcement against Jankel's nonpayment demonstrates the amendment benefits both Chavez and Jankel, forcing the remaining members of the Association to cover the share of debt for Chavez and Jankel's lot.

- The association's selective enforcement of assessments has resulted in a number of other members being penalized for failing to pay their dues, even as Chavez and Jankel have evaded their own financial obligations. To compound matters, Chavez has signed liens against many other members who owed significantly less than he and Jankel.

HOAs, like the El Mirador Homeowners Association, are required to follow their governing documents, which include the bylaws. Our community documents set out the procedures that the Association must follow to amend its bylaws. If the board of directors did not follow these procedures, then the amendment to the bylaws is invalid. Section 47-16-18, from the New Mexico Homeowner Association Act, requires all homeowners associations (HOAs) and lot owners to comply with the Act and the HOA's governing documents.

Members of the Association trust the board of directors to act in their best interests. When the board of directors makes unauthorized amendments to the bylaws, or other community documents, it is betraying that trust which results in negative consequences for members.

In Bylaws art. V for the El Mirador Subdivision the process for amendment is clearly set forth as follows:

ARTICLE V - AMENDMENT

These Bylaws may be amended by a majority vote of the members of the Association provided that notice of the subject matter of the proposed amendment shall be included in the notice of any meeting at which the proposed amendment is to be considered, and further provided that no amendment shall be in violation of the Covenants for El Mirador Subdivision. Any amendments approved by the members of the Association shall be certified by the President and Secretary and shall be effective when recorded in the office of the County Clerk of Doña Ana County, New Mexico.

Let's unpack the amendment, the events surrounding its recording on February 23, 2023, and the air of secrecy maintained by the El Mirador HOA Board of Directors and its management company, DANA Properties.

Why compensate a volunteer board position, such as Treasurer or other officer?

Compensating board members of a nonprofit organization is a controversial topic. The predominant theory is that board members are volunteers and should not be compensated because it creates a conflict of interest. Board members who are compensated are more likely to make decisions that benefit their own personal interests rather than the interests of the organization. Officers that receive compensation for their service as board members can lose immunity in lawsuits against the Association. There is also the issue of services provided; If the officer is not a professional then why compensate them? Why not just hire a professional and eliminate any controversy altogether?

In our Association, if it were properly functioning, Design Review Committee members would work harder to fulfill their obligations to the members than Treasurer, while they are expressly forbidden compensation for their efforts. With this amendment, the Board attempts to carve out an exception for a single individual, despite the fact that the bylaws clearly state that "no amendment shall be in violation of the Covenants for El Mirador Subdivision." This amendment is in direct conflict with Declaration § 5.9:

5.9 No Offset. All Assessments shall be payable in the amount specified in the Assessment or notice of Assessment and no offsets against such amount shall be permitted by any reason, including, without limitation, a claim that (a) the Association, the Board, the President or the Declarant is not properly exercising its duties and powers as provided in this Declaration; (b) Assessments for any period exceed Common Expenses; or (c) a Member has made, and elects to make, no use of the Common Areas

The expressed purpose of the amendment is to allow the Treasurer to offset his Regular Assessments, we presume, through service as an officer of the Board of Directors. Lot owners are not allowed to offset their assessments "by any reason." We will also address the matter of what compensation is being allowed, as the text of the amendment is unclear on that issue.

What is the intent and effect of the amendment?

We should review the actual text of the amendment to see what it intends to achieve in benefit of the members of the Association. It is comprised of exactly nineteen (19) words and one comma; "with exception of the Treasurer whose compensation shall be a waiver of their monthly Association Dues while in office," which has been inserted into the existing Bylaws art. III § 9 as follows:

Section 9. Compensation; Expenses: Indemnity. Directors shall receive no compensation for their services as a Director, with exception of the Treasurer whose compensation shall be a waiver of their monthly Association Dues while in office, provided that nothing herein contained shall preclude any Director from serving the Association in any other capacity and receiving compensation therefor. Directors shall be reimbursed from the funds of the Association for all their expenses incurred on behalf of the Association with respect to their duties as a director. Directors shall have no personal liability for acts of the Board on behalf of the Association.

A rule is a formula for making a decision.1 Bylaws are written rules that control the internal affairs of an organization. They usually have section headings called "articles" and paragraphs called "sections" to make them more readable and standardized. The purpose of sections and subsections in bylaws is to organize the content and make it easier to navigate.

Examining the specific text of the amendment demonstrates that there are issues with this rule:

- First, the exception for the Treasurer is somewhat problematic. It is not clear why the Treasurer should be compensated for their services while other directors are not. This could create a conflict of interest for the Treasurer, as they may be more likely to make decisions that benefit themselves financially.

- Second, the rule does not specify what is meant by "Association Dues". This could lead to disputes over which assessments are eligible for waiver or if fines and other penalties due the Association are included. It would be better to have a more specific policy in place that outlines specifically what is being waived.

The purpose of amending homeowner association (HOA) bylaws is to update the rules and regulations that govern the community to ensure that it remains consistent with state and local law, reflects the changing needs of the community, and is efficient and effective. The benefits of amending HOA bylaws include:

- Maintaining compliance with state and local law: HOA bylaws must be consistent with state and local law. Amending the bylaws can help to ensure that the HOA is in compliance with all applicable laws.

- Addressing new issues or concerns: As the community evolves, new issues and concerns may arise. Amending the bylaws can help to provide guidance on how to address these new challenges.

- Clarifying or refining existing provisions: Over time, the meaning of certain bylaw provisions may become unclear or outdated. Amending the bylaws can help to clarify or refine these provisions to improve their clarity and enforceability.

- Improving the overall efficiency and effectiveness of the HOA: Amending the bylaws can help to streamline the HOA's operations and make it more efficient and effective. For example, the HOA may amend its bylaws to update its voting procedures or to create new committees to address specific issues.

Who benefits from this amendment?

The amendment's sole beneficiary is the current Treasurer, David Chavez, Jr. He has held the position of Treasurer for the past 17 electoral cycles, and no other person has served in that role during that time.

In addition to Chavez' waiver, the association has tacitly permitted his joint tenant, Francis Jankel, to avoid paying his share of dues for the same 16-year period on the lot they co-own: 333 Avenida Mirador. The association's selective enforcement of assessments has resulted in a number of other members being penalized for failing to pay their dues, even as Chavez and Jankel have evaded their own financial obligations. To compound matters, Chavez has signed liens against many other members who owed significantly less than he and Jankel.

Amendment to Bylaws of the El Mirador Homeowners Association, February 23, 2020

1. K. Neumann, R. (2001). Legal Reasoning and Legal Writing (4th ed.). Aspen Publishers, Inc.